Recently I have faced enrollment for the “Medicare Benefit” which is mandated at age 65. People talk about this experience with a bit of cynical humor, as “Social Security” has been imposed upon the American population since 1937.

Whatever the objections, when your age reaches 65 years, you must apply for Medicare health insurance. Whether you have your health care needs covered already is irrelevant. If you’re already 65 you already know this, and if you’re not 65 no one will warn you just in case you might object – your ignorance is their bliss. Anyway…..

To ensure your compliance, all of your existing health insurance will be canceled on you effective the first day of the month in which you turn 65. Moving right along….

Interesting data I uncovered during all this ado about outliving many of my peers and all the implications and details of retiring early is what brings me to this article.

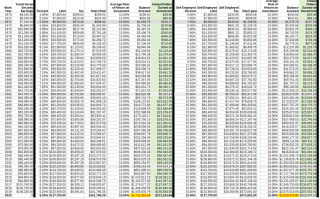

Skipping the Constitutional implications of forcing people to buy a product and the civil rights violations of targeting people based only upon their age, let us look at what value all those FICA “Social Security” contributions should have today, had they been invested properly in a generic, average performing, mutual fund. The .ods spread sheet can be downloaded from my link at ssa-investment-calculator-1951-2020.

This sheet is written in the free to have and freely available Open Document Format using LibreOffice Calc spreadsheet.

The Open Document Format for Office Applications (ODF), also known as OpenDocument, is a ZIP-compressed[6] XML-based file format for spreadsheets, charts, presentations and word processing documents. It was developed with the aim of providing an open, XML-based file format specification for office applications.[7]

The standard was developed by a technical committee in the Organization for the Advancement of Structured Information Standards (OASIS) consortium.[8] It was based on the Sun Microsystems specification for OpenOffice.org XML, the default format for OpenOffice.org and LibreOffice. It was originally developed for StarOffice “to provide an open standard for office documents.”[9]

In addition to being an OASIS standard, it was published as an ISO/IEC international standard ISO/IEC 26300 – Open Document Format for Office Applications (OpenDocument).[

Microsoft Office should have no problem reading this sheet, and LibreOffice is free and freely available online for Windows, Linux, and Mac.

Here is a sample of the result, for an average worker earning 80% of the FICA wage limit.

To use the sheet to learn how much money you should have right now, browse to http://ssa.gov. If you do not have an account on this US government official website, you need to enroll now. You should already be downloading and reviewing your own Social Security data from this sight every year as a matter of protecting yourself from identity theft. Once logged in you will land on the page shown above. Click on the Print Save Your Full Statement link to download your own data.

Locate your FICA wage data in your Social Security statement column labeled “Taxed Social Security Earnings” and enter it in that spreadsheet next to each year that you worked. Look at the bottom line. If you are a business owner, until year 2019 you have had to pay more than double the amount paid by conventional employees (some thanks we get for making jobs).

The bottom line will tell you how much your mutual fund would be worth today IF you had invested that money in a typical mutual find instead of giving it to the government. It is an eye opener. As a sample, I have run a sheet for a person with mere average earnings at 80% of the maximum amount taxable for FICA, from 1970 (which is about when I started working) to present.